Ways to Get Involved

Get involved with MDA and help transform lives of people living with muscular dystrophy, ALS, and related neuromuscular diseases.

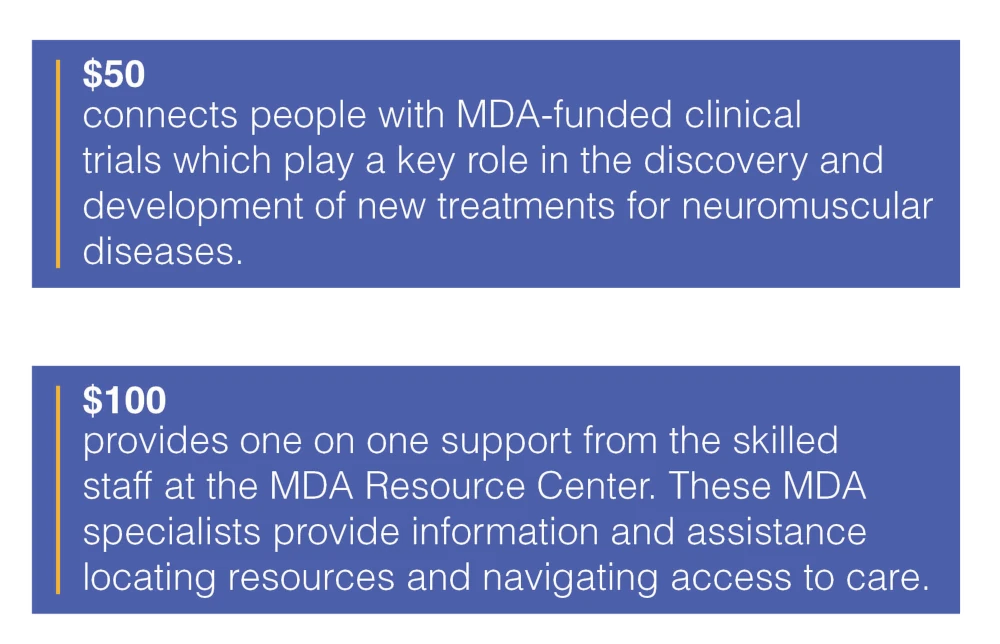

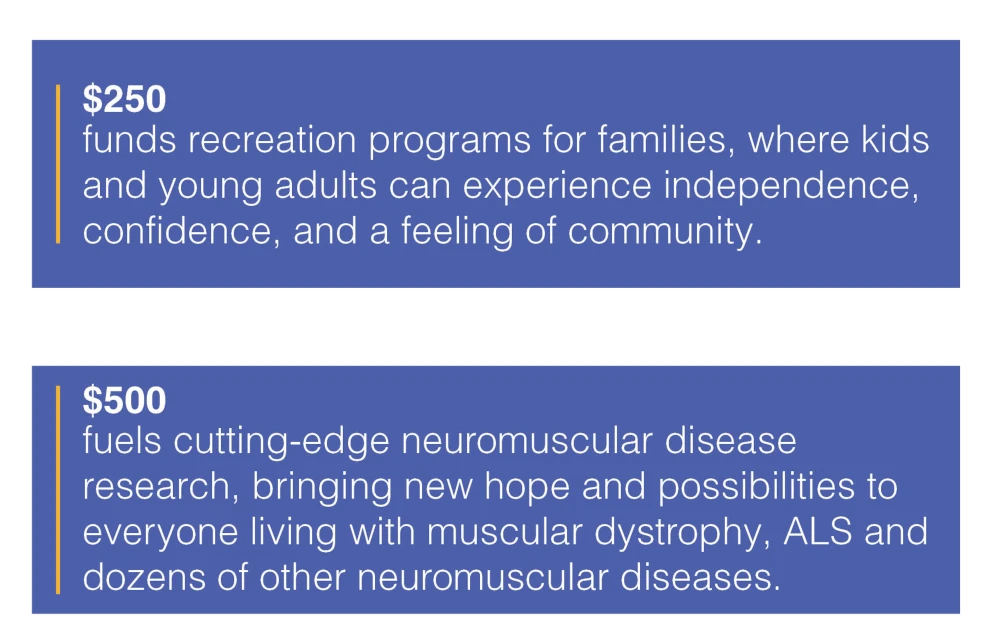

Ways to Donate

-

Donate Now

Donate Now

-

Donate Monthly

Donate Monthly

-

Donate by Phone

1-888-HELP-MDA -

Donate by Mail

Donate by Mail

Participate in an Event

Whether virtual or in-person, you can join your community at an MDA event to raise vital funds and bring awareness for MDA families. Your involvement enables MDA to fund groundbreaking research for promising treatments and provide families with the highest quality care from the best doctors in the country.

-

Muscle Walk

Muscle Walk

Join your local Muscle Walk to support and celebrate families in your community. Every fundraising event includes a 3K to 5K course designed for participants of all ages and abilities, including a wheelchair and equipment-friendly course. Now, each race can be done virtually on your own home course!

-

Team Momentum

Team Momentum

Team Momentum empowers individuals of all athletic abilities to train fo a half or full marathon while supporting MDA. Dedicate your miles – either in a formalized race or on your own course.

-

Let's Play

Let's Play

MDA Let’s Play is a community of patients, supporters, friends and family united by a love of gaming. MDA has created a unique space with Let’s Play where those living with neuromuscular diseases can have fun, explore creativity and create strong social connections with fellow patients, other gamers and supporters.

-

Shamrocks Retail Campaign

Shamrocks Retail Campaign

The iconic MDA Shamrocks pinup program is one of the nation's largest St. Patrick's Day fundraisers. What started in a local pub 39 years ago has since grown to thousands of retail locations nationwide and has raised more than $330 million for MDA. When you buy a paper Shamrock in store, or purchase a virtual Shamrock online, you’re helping give strength to kids and adults with muscular dystrophy, ALS, and related neuromuscular diseases.

-

Summer Camp Retail Campaign

Summer Camp Retail Campaign

Our Summer Camp focused retail campaign highlights one of MDA's integral programs and provides children with living muscular dystrophy and related neuromuscular diseases the opportunity to stay connected and engaged at MDA Summer Camp at no cost to their family.

-

Holiday Retail Campaign

Holiday Retail Campaign

MDA Holiday Retail Campaign focuses on giving to MDA during the holiday season. The program includes pinups or round up options and helps customers transform the lives of people living with muscular dystrophy, ALS, and related neuromuscular diseases during the holiday season.

MDA Resource Center:

We're Here For You

Our trained specialists are here to provide one-on-one support for every part of your journey. Send a message below or call us at 1-833-ASK-MDA1 (1-833-275-6321). If you live outside the U.S., we may be able to connect you to muscular dystrophy groups in your area, but MDA services are only available in the U.S.

Stay In Touch

Stay up-to-date with the latest MDA news and activities by joining our mailing list.